21. Nan Chen CFA is comparing a firm with two of

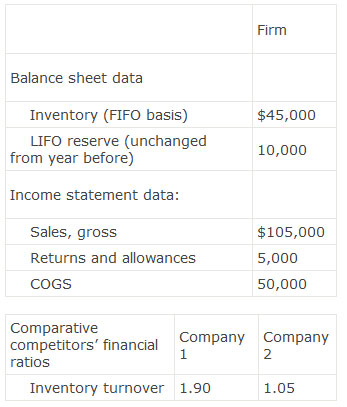

21. Nan Chen, CFA, is comparing a firm with two of its industry competitors. She obtains the following financial excerpts from the firm’s financial statements, as well as the inventory turnover ratio on two of its competitors.

The firm uses the LIFO inventory costing method under U.S.GAAP, which is consistent with its industry competitors. What conclusions should the analyst reach when comparing the firm’s inventory turnover ratio to those of ties competitors? A. Outperformed both competitors. B. Outperformed Company 1 only. C. Outperformed Company 2 only.

参考解答

Ans: C.

To calculate inventory, the FIFO inventory value must be adjusted to a FIFO value to be consistent with the other firms. With a $10,000 LIFO reserve that means that the FIFO inventory value is $10,000 more than a LIFO value inventory. Inventory turnover =![]() =

=![]() =

=![]() = 1.43 which is less than 1.90 (#1) and more than 1.05 (#2). Note: if the LIFO reserve had changed the COGS would have to also be adjusted by adding the increase, or subtractive the decrease, from COGS to adjust the FIFO COGS to LIFO.

= 1.43 which is less than 1.90 (#1) and more than 1.05 (#2). Note: if the LIFO reserve had changed the COGS would have to also be adjusted by adding the increase, or subtractive the decrease, from COGS to adjust the FIFO COGS to LIFO.

相似问题

Which of the following trends may signal the begin

Which of the following trends may signal the beginning of a liquidity crisis for an entity?A A shift from operating debt to

When comparing two firms an analyst shouldmost ap

When comparing two firms, an analyst shouldmost appropriately adjust the financial statements when they include significant:A

A company reports that to maintain good relations

A company reports that to maintain good relations with its suppliers, it has entered into a financing arrangement with a ba

Zhan Wang CFA is analyzing Bao Company by projec

Zhan Wang, CFA, is analyzing Bao Company by projecting pro forma financial statements Zhan expects Bao to generate sales of

下列关于基金宣传推介材料规范的说法中 正确的是( )A.推介货币市场基金的 可以保证最低收益B.电台

下列关于基金宣传推介材料规范的说法中,正确的是( )A 推介货币市场基金的,可以保证最低收益B 电台广播应当以旁白形式提示投资人注意风险并参考该基金