A company with no interest-bearing debt enters int

A company with no interest-bearing debt enters into a finance lease on the first day on the reporting year. The lease requires a year-end payment of $175,000 for 10 years. In the second year of the lease, the company reported the EBIT of $450,000. Assuming a 7% imputed interest rate on the lease, the firm’s interest coverage ratio in the second year is closest to:

A. 4.3X

B. 5.2X

C. 5.6X

参考解答

Ans:C.

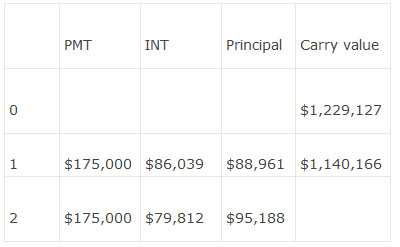

The present value of the lease payment with an anunual payment of $175,000 (PMT) at the end of the year over the 10 year period (N), discounted at 7% (1/Y), is $1,229,127 (solve for PV). Interest during the second year of the lease is $1,140,166 * 0.07= $79,812.

Interest during the second year of the lease is $1,140,166 * 0.07= $79,812.![]()

相似问题

The most likely impact on a lessee’s financial sta

The most likely impact on a lessee’s financial statements from reporting a lease as a finance lease rather than as an ope

When a bondholder converts a convertible bond the

When a bondholder converts a convertible bond, the effects on the corporation’s subsequent financial statements will include

The following information is available from a comp

The following information is available from a company’s 2011 financial statements:Note 6: Employee costsNote 17: Retirement be

A retail company that leases the majority of its s

A retail company that leases the majority of its space has:·total assets of $4,500 million,·total long-term debt of $2,125

Backhoe Partners (BP) sells each of its backhoes f

Backhoe Partners (BP) sells each of its backhoes for $175,000 with an expected economic life of 10 years The company also