A retail company that leases the majority of its s

A retail company that leases the majority of its space has:

·total assets of $4,500 million,

·total long-term debt of $2,125 million, and

·average interest rate on debt of 12%.

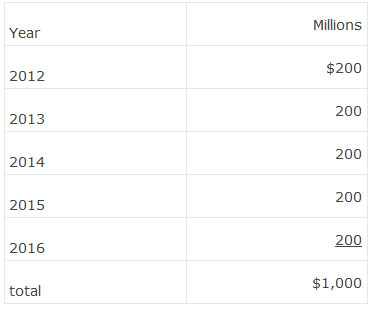

Note 8 to the 2011 financial statements contains the following information about the company’s future beginning of year lease commitments:

Note 8: Operating leases

After adjustment for the off-balance-sheet financing, the debt-to-total-assets ratio for the company is closest to:

A. 55%.

B. 57%.

C. 65%.

参考解答

Ans:A.

The present value of the operating leases should be added to both the total debt and the total assets.

The present value of an annuity due of $200 for 5 years at 12% = $807.5.

(N = 5; I = 12; PMT = 200; Mode = Begin)

Adjusted debt to total assets = (2,125 + 807.5) ÷ (4,500 + 807.5) = 55.3%.

相似问题

Backhoe Partners (BP) sells each of its backhoes f

Backhoe Partners (BP) sells each of its backhoes for $175,000 with an expected economic life of 10 years The company also

A company is considering issuing $10 000 000 of lo

A company is considering issuing $10,000,000 of long-term debt with a 6% coupon rate or the same amount of convertible debt

Which of the following is most likely a reason tha

Which of the following is most likely a reason that a lessor can offer attractive lease terms and lower cost financing to

An analyst makes the appropriate adjustments to th

An analyst makes the appropriate adjustments to the financial statements of retail companies that are lessees using a substan

A capital lease requires annual lease payments of

A capital lease requires annual lease payments of $2,000 at the start of each year Fair value of the leased equipment at i