A Canadian printing company which prepares its fin

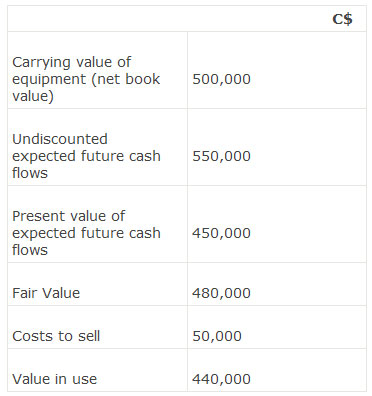

A Canadian printing company which prepares its financial statements according to IFRS has experienced a decline in the demand for its products. The following information relates to the company’s printing equipment as of 31 December 2010.

The impairment loss (in C$) is closest to:

A. 0.

B. 60,000.

C. 70,000.

参考解答

Ans:B.

Under IFRS, an asset is considered to be impaired when its carrying amount exceeds its recoverable amount (the higher of fair value less cost to sell or value in use).

Fair value less costs to sell: 480,000 – 50,000 = 430,000

Value in use = 440,000

Recoverable amount (higher value) = 440,000

Impairment loss under IFRS = Carrying value – recoverable amount = 500,000 – 440,000 = 60,000

Note: impairment of long-lived tangible assets held for use

An impairment loss is recognized when the carrying (book) value of the tangible of the asset exceeds its fair value and the carrying value is not recoverable. Impairment losses are recognized on the income statement.

Under IFRS, an impairment loss exists when the carrying value of an asset exceeds the recoverable amount. The recoverable amount is the greater of its fair value less any selling costs and its value in use. The value in use is the present value of its future cash flow.

Under U.S.GAAP, an asset is tested for impairment only when events and circumstance indicate the firm may not be able to recover the carrying value through future use.

Recoverability test. An asset is considered impaired if the carrying value (original cost less accumulated depreciation) is greater than the asset’s future undiscounted cash flow stream.

Loss measurement. If impaired, the asset’s value is written down to fair value on the balance sheet and a loss, equal to the excess of carrying value over the fair value of the asset (or the discounted value of its future cash flows if the fair value is not known), is recognized in the income statement.

相似问题

An analyst gathers the following information ($ mi

An analyst gathers the following information ($ millions) about three companies operating in the same industry:Although the co

Which of the following would most likely be lower

Which of the following would most likely be lower in the early years of an asset’s life using accelerated depreciation met

At the start of the year a company acquired new e

At the start of the year, a company acquired new equipment at a cost of €50,000, estimated to have a 3 year life and a

A company prepares its financial statements in acc

A company prepares its financial statements in accordance with U S GAAP (generally accepted accounting principles) It expecte

A company which prepares its financial statements

A company, which prepares its financial statements in accordance with IFRS uses the revaluation model to value land At the