At the start of the year a company acquired new e

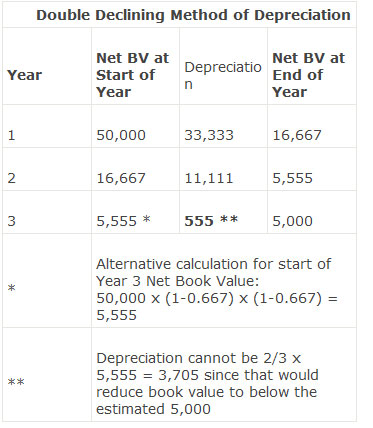

At the start of the year, a company acquired new equipment at a cost of €50,000, estimated to have a 3 year life and a residual value of €5,000. If the company depreciates the asset using the double declining balance method, the depreciation expense that the company will report for the third year is closest to:

A. €555.

B. €3,328.

C. €3,705.

参考解答

Ans:A.

Under double declining balance method, the depreciation rate would be 2 x the straight line rate of 33.3%, i.e., 66.6%, or 2/3 depreciation rate per year. However, the asset should not be depreciated below its assumed residual value in any year.

相似问题

A company prepares its financial statements in acc

A company prepares its financial statements in accordance with U S GAAP (generally accepted accounting principles) It expecte

A company which prepares its financial statements

A company, which prepares its financial statements in accordance with IFRS uses the revaluation model to value land At the

For which type of long-lived asset is it most appr

For which type of long-lived asset is it most appropriate to test for impairment at least annually:A Property, plant and equipment B Intangible assets with finite live C Intangible assets with indefinite lives

The capitalization of interest (versus expensing)

The capitalization of interest (versus expensing) will have which of the following effects on a company’s financial ratios?A Lower interest coverage ratio B Lower debt-to-equity ratio C Higher asset turnover ratio

A European based company follows IFRS (Internation

A European based company follows IFRS (International Financial Reporting Standards) and capitalizes new product development cost