A company issued $2 000 000 of bonds with a 20 yea

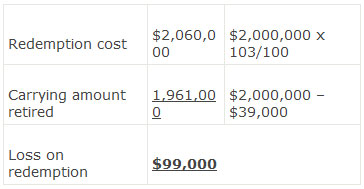

A company issued $2,000,000 of bonds with a 20 year maturity at 96.Seven years later, the company called the bonds at 103 when the unamortized discount was $39,000.The company would most likely report a loss of:

A.$60,000.

B.$99,000.

C.$138,000.

参考解答

Ans:B.

相似问题

10. On 1 January 2009 a company that prepares its

10 On 1 January 2009, a company that prepares its financial statements according to IFRS issued bonds with the following f

Given the following information about a company:Wh

Given the following information about a company:What is the most appropriate conclusion an analyst can make about the solvenc

Compared to classifying a lease as a financing lea

Compared to classifying a lease as a financing lease, if a lessee reports the lease as an operating lease it will most li

Which of the following is most likely a benefit of

Which of the following is most likely a benefit of debt covenants for the borrower?A Reduction in the cost of borrowing B Li

On 1 January 2011 the market rate of interest on a

On 1 January 2011 the market rate of interest on a company’s bonds is 5% and it issues a bond with the following charac