On 1 January 2011 the market rate of interest on a

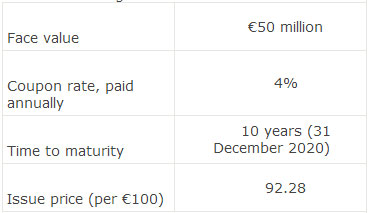

On 1 January 2011 the market rate of interest on a company’s bonds is 5% and it issues a bond with the following characteristics:

If the company uses IFRS, its interest expense (in millions) in 2011 is closest to:

A.€1.846.

B.€2.307.

C.€2.386.

参考解答

Ans:B.

IFRS requires the effective interest method for the amortization of bond discounts/premiums.The bond is issued for 0.9228 × €50 million = €46.140.

Interest expense

= Liability value × Market rate at issuance

= 0.05 × €46.140 = €2.307.

相似问题

A company which prepares its financial statements

A company, which prepares its financial statements in accordance with IFRS issues £5,000,000 face value ten year bonds on J

A company issued a $50 000 7-year bond for $47 565

A company issued a $50,000 7-year bond for $47,565 The bonds pay 9 percent per annum and the yield-to-maturity at issue was

关于房地产权益基金 以下表述错误的是( )A.房地产权益基金可以通过在非公开市场上出售其所持的资产退

关于房地产权益基金,以下表述错误的是( )A 房地产权益基金可以通过在非公开市场上出售其所持的资产退出关于房地产权益基金,以下表述错误的是( )2016

自上而下股票投资策略在实际应用中 不包括( )A.根据宏观经济研究决定大类资产配置B.从周期非型行业

自上而下股票投资策略在实际应用中,不包括( )A 根据宏观经济研究决定大类资产配置B 从周期非型行业转换为周期型行业,从而获得板块的差额收益(2016年9

甲公司2015年资产总计为3000亿元 负债总计为2000亿元 则甲公司2015年的所有者权益为(

甲公司2015年资产总计为3000亿元,负债总计为2000亿元,则甲公司2015年的所有者权益为( )A 2000亿元B 3000亿元C 5000亿元D 1000亿元(2016年9月基金《基金基础》真题)