Using the BEY (bond-equivalent yield) spot rates f

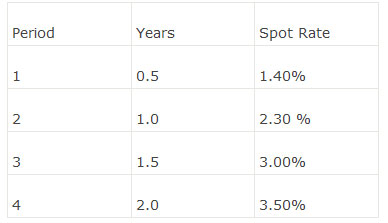

Using the BEY (bond-equivalent yield) spot rates for U.S. Treasury yields provided in the following table, the 6-month forward rate one year from now on a bond-equivalent yield basis is closest to:

A. 4.41%

B. 2.20%

C. 2.30%

参考解答

Ans:A

Assume:

xfy represents x-period forward rate y-period from now;

Z x+y represents (x+y)-period spot rate;

Z y represents y-period spot rate.

We have (1+Z x+y)x+y=(1+Zy)y (1+xfy)x

6-month forward rate one year from now in this case is 1 period forward rate 2-period from now.

All spot rates are given on a BEY basis and must be divided by 2 in the calculation:

(1+1f 2)1 (1+0.023/2)2=(1+0.03/2)3

1f 2=0.022038

On a BEY basis, the forward rate is 0.022038*2=4.41%

相似问题

Elaine Wong has purchased an 8% coupon bond for $1

Elaine Wong has purchased an 8% coupon bond for $1,034 88 with 3 years to maturity At what rate must the coupon payments be reinvested to produce a 5% yield-to-maturity rate?A 8%B 6 5%C 5%

The U.S. Treasury spot rates are listed as follows

The U S Treasury spot rates are listed as follows The arbitrage-free value of a 2-year Treasury, $100 par value bond with a 6% coupon rate is closet to:A $107 03 B $105 25 C $99 75

大丰公司2013年1月发生以下经济业务:(1)销售产品一批 价款为60000元 增值税为10200元

大丰公司2013年1月发生以下经济业务:(1)销售产品一批,价款为60000元,增值税为10200元。款项收到存入银行。该批产品的成本为28000元。(2)购入原材料400

签发现金支票和用于支取现金的( )支票必须符合国家现金管理的规定。A.特种B.划线C.转账D.普通

签发现金支票和用于支取现金的( )支票必须符合国家现金管理的规定。A 特种B 划线C 转账D 普通

The U.S. Treasury spot rates are provided in the f

The U S Treasury spot rates are provided in the following table:Given a consistent corporate spread of 0 50%, what will be