A 3-year amortizing security with a par value of $

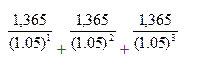

A 3-year amortizing security with a par value of $4,000 and a 6% coupon rate has an expected cash flow of $1,365 per year. No principal prepayment is allowed. Assuming a discount rate of 5%, the security is most likely to have a present value of:

A. 4,109.

B. 4,000.

C. 3,717.

参考解答

Ans:C

C is correct because =3717

=3717

相似问题

Consider a $1 000 par value bond with an annual p

Consider a $1,000 par value bond, with an annual paid coupon of 7%, maturing in 10 years If the bond is currently selling for $980 74, the YTM isclosest to:A 8 28%B 7 28%C 6 28%

Which of the following statement is correct about

Which of the following statement is correct about the option adjusted spread ( OAS ):A OAS is Z-Spread minus the option cost B OAS is the value of the embedded option C OAS is Z-spread plus the option cost

Tapper Inc. has two $1 000 par value bonds outsta

Tapper, Inc has two $1,000 par value bonds outstanding that both sell for 758 18 The first issue has 15 years to maturit

甲企业2011年12月的试算平衡表如下:1.长期借款期末余额中将于一年内到期归还的长期借款数为450

甲企业2011年12月的试算平衡表如下:1 长期借款期末余额中将于一年内到期归还的长期借款数为45000元。计算资产负债表中下列报表项目,试算平衡表 2011年1

The zero-volatility spread is a measure of the spr

The zero-volatility spread is a measure of the spread off:A one point on the Treasury yield curve B all points on the Treasury yield curve C all points on the Treasury spot curve