An analyst is comparing the financial statements o

An analyst is comparing the financial statements of Company A and Company B. both companies have incurred expenses of approximately $250 million in the current year to expand their production facilities. Company A is highly leveraged. Company B does not have any outstanding debt and paid the $250 million from internal cash reserves. The most likely effect of the difference in the capital structures of the two companies will be:

A. Company A will report higher asset balances related to the facilities under construction.

B. The companies will report the same asset balances related to the facilities under construction.

C. Company A’s interest coverage ratio will be lower than it would have been if the company had expensed all interest.

参考解答

Ans:A.

Since Company A is leveraged, it will be required to capitalize the interest related to the construction project even if there was no borrowing specially for the $250 million (an assumption is made that the money actually came from some kind of borrowing, even if there is no specific loan for the amount). Company B on the other hand, will not have any interest to capitalize. As a result, Company A’s balance sheet will reflect an amount in excess of the $250 million for the facilities under construction, while Company B will reflect only the $250 million.

B is incorrect. Company A will report an amount in excess of the $250 million in construction costs, which includes the capitalized interest related to the project. Company B, on the other hand, will not have any capitalized interest to report.

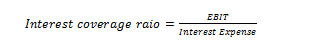

C is incorrect. If interest is capitalized, EBIT is unchanged and interest expense falls. These changes will cause the interest coverage ratio to be higher, not lower.

If interest is capitalized, EBIT is unchanged and interest expense falls. These changes will cause the interest coverage ratio to be higher, not lower.

相似问题

Which statement regarding sinking funds is least l

Which statement regarding sinking funds is least likely correct?A Sinking fund provisions require the retirement of a portion

A bond market analyst states “The current term st

A bond market analyst states, “The current term structure of interest rates is upward sloping which implies the market beli

An investor sells a bond at the quoted price of$98

An investor sells a bond at the quoted price of$98 00 In addition he receives accrued interest of $4 40 The clean price

Compared with an otherwise identical amortizing se

Compared with an otherwise identical amortizing security, a zero-coupon bond will most likely have:A less reinvestment risk and

An investor purchases a 5% coupon bond maturing in

An investor purchases a 5% coupon bond maturing in 15 years for par value Immediately after purchase, the yield required b