A 10-year bond is issued on January 1 2010. Its c

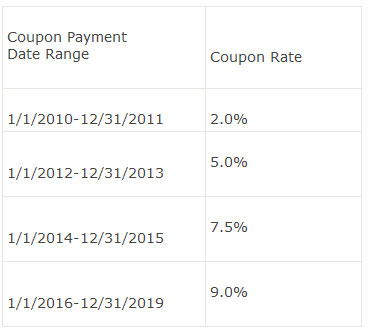

A 10-year bond is issued on January 1, 2010. Its contract requires that its coupon rate change over time as shown in the following table:

This security is best described as an example of a:

A. step-up note.

B. inverse floater.

C. deferred coupon bond.

参考解答

Ans:A;

A is correct step-up notes have coupon rates that increase over time at a specified rate. The increase may take place one or more times during the life of the issue.

相似问题

A moral obligation bond is also known as:A. a gene

A moral obligation bond is also known as:A a general obligation debt B a prerefunded bond C an appropriation-backed obligation

An analyst is evaluating various debt securities i

An analyst is evaluating various debt securities issued by a company The type ofsecurity that is most likely to yield the lowest recovery in a bankruptcy is a:A debenture bond B collateral trust bond C mortgage bond

All U.S. Treasury coupon strips are:A. zero-coupon

All U S Treasury coupon strips are:A zero-coupon securities B issued directly by the U S Treasury C created from pooled coupon payments of U S Treasury securities

Which of the following provides the most flexibili

Which of the following provides the most flexibility for the bond issuer?A Put provisionB Call provisionC Sinking fund provision

If investors expect stable rates of inflation in t

If investors expect stable rates of inflation in the future, the pure expectations theory suggests that the yield curve is currently:A upward sloping B flat C inverted